Tax Classification to be decided at Gardner MA City Council Meeting on November 20, 2023

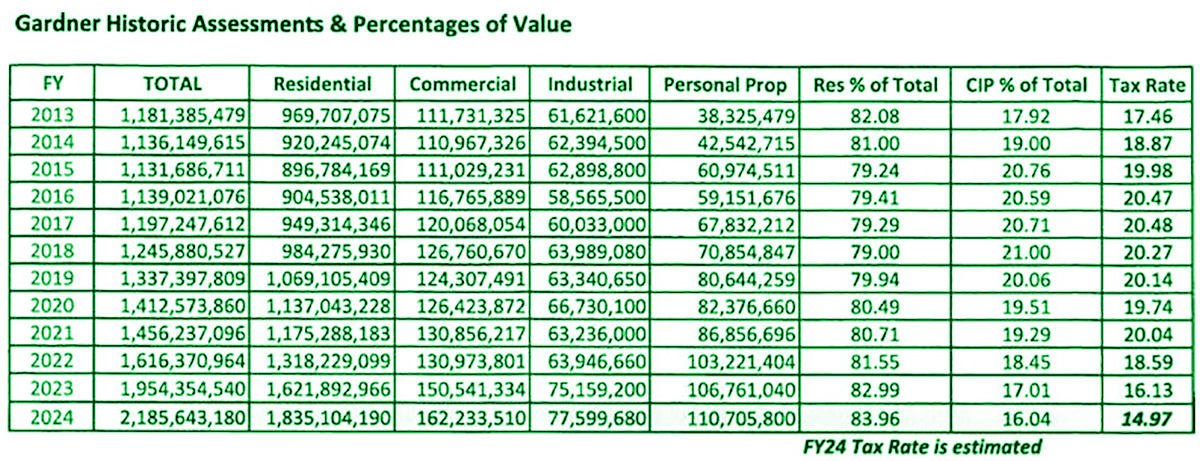

As part of the November 20th meeting, there will be a Tax Classification Hearing – There is further related information in the complete packet of 555 pages, CLICK HERE. The City has traditionally utilized a single tax rate where business, industrial, residential, and land are taxed at the same rate. This encourages business. However, in recent years, the value of residential property has gone up more than business and industrial and therefore, by default, the burden has shifted somewhat to residential. The tax rate is projected to be under $15 per thousand, the lowest in over a decade. However, a tax rate generally goes down if property values rise considerably, which is the case in Gardner MA.

Residential as a percentage of total value 10 years ago in 2013 was 82%. 5 years later in 2018 it was 79%. It has gradually risen since then to just under 84%. However, Gardner has recently had an upswing in business renovating existing structures, greatly increasing value now and more in the future as projects are completed and others are commenced. However, for fiscal year 2024, the state mandates a look back to a couple of years ago. Therefore, the City won’t see the complete help the influx of business will have to residential tax bills until things catch up.

According to Mayor Michael Nicholson, “The City has made large strides in our economic development goals in recent years, and we are starting to see a very strong return on our investments in these endeavors. The Administration supports the recommendation of the Board of Assessors by continuing with a single tax rate…”