Listen to the Press Conference on any device. CLICK PLAY.

Complete details on each item are in the Press Release from Governor’s Office, CLICK HERE.

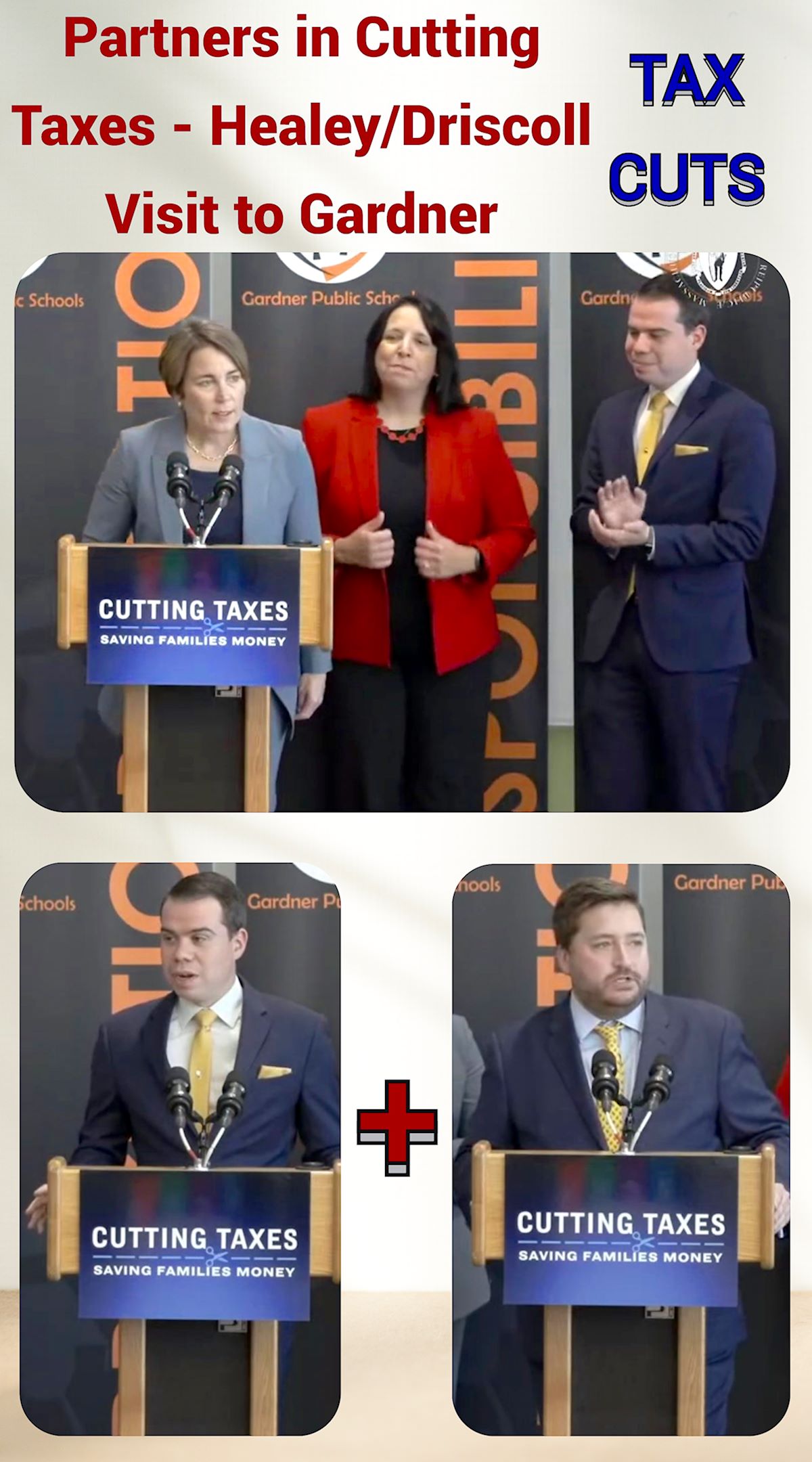

MA Governor Maura Healey visits Gardner MA to Highlight Tax Cuts

Massachusetts Governor Maura Healey was at Gardner Elementary School on October 5, 2023 to highlight the tax cut package signed into law on Wednesday, October 4th.

UPDATE: The Press Conference held in the library of Gardner Elementary School at noon featured Governor Healey, Lt. Gov Driscoll, Mayor Michael Nicholson, Representative Jon Zlotnik, and others speaking on the positive impact of the tax cuts. Other members of the Healey Administration were scheduled to be present. After the event, the Governor was on her way to Haverhill.

$1 Billion in Tax Cuts

Provisions of the Tax cuts package include increased child and family tax credit, an increase in the Earned Income Tax Credit, an increase in the estate tax threshold, a reduction in short-term capital gains, an increase in the allowed rental deduction, a doubling of the senior circuit breaker tax credit, changes 3 factor apportionment system for businesses to apportionment based solely on sales, increases the annual cap of the low income housing tax credit from $40 million to $60 million, increases the annual cap of the Housing Development Incentive Program from $10 million to $57 million in 2023, and thereafter to $30 million annually, exempts employer assistance for student loan repayment from taxable income, increases the dairy tax credit program cap from $6 million to $8 million, applies low tax rates to a broadened class of beverages, doubles the lead paint abatement credit to $3000 for full abatement and $1000 for partial abatement, increases Title V Septic Tax Credits, adds items to deductible commuter transit benefits, expands eligible occupations for the apprenticeship tax credit, permits municipalities to adopt local property tax exemption for affordable real estate, increases the allowable property tax abatement available to seniors who perform volunteer services from $1500 to $2000, and increases the stabilization fund cap to $25.5% for the current 15%.